E-File Form 990-N (e-Postcard) Online

Search EIN, choose tax year, & transmit your 990-N to the IRS!

*We will retrieve your organization’s information from the IRS registry

- File from any device

- Dedicated customer support

- Supports prior years' filing

Exclusive Features for Filing Form 990-N (e-Postcard)

Tax990 is an IRS-authorized e-file software trusted by thousands of tax-exempt organizations each year. We offer a simple and reliable solution for filing Form 990-N (e-Postcard) online.

User-Friendly Interface

Tax990 offers a user-friendly interface and easy navigation, making it simple to file your 990-N returns from any device.

Expert Assistance

Our team of experts is here to assist you through every step of the filing process via live chat, phone, and email.

Get Instant Status Updates

Stay updated with instant email and text notifications about the IRS status of your Form 990-N.

Prior Year Filing

Tax990 lets you file Form 990-N for the current tax year and the two previous years (2022 and 2023).

Free Re-transmission of Rejected Returns

If the IRS rejects your Form 990-N for any reason, you can retransmit it at no extra cost. We've got you covered!

Access to Previous Filings

Our software provides you with easy access to your organization’s 990-N filing history.

Previous Filing History

Our software provides you with access to your organization’s 990-N filing history.

E-file Unlimited Returns From One Account

You can transmit returns for an unlimited number of organizations through a single account.

Live Customer Support

If you have any issues, you can contact our expert support team via live chat, email, or phone.

Exclusive PRO Features for Tax Professionals to File 990 N!

Effortlessly manage multiple clients with Tax990! Organize unlimited organizations and their tax filings—all from one account.

Staff Management

Invite your team members and assign them tasks to assist with preparing and submitting 990 filings for the clients.

Client Management

Easily prepare and manage 990 filings for a large number of clients with multiple EINs and also ensure clients review their returns through a secure portal before submission.

E-Signing Options

Tax990 offers easy e-sign options for Form 8453-TE and Form 8879-TE, making your filing process even smoother.

Flexible Pricing

With our volume-based pricing packages, the more you file, the more you save, providing control over your filing expenses.

Ready to file 990-N (e-postcard) for your clients?

Try Our Form 990-N (e-Postcard) Mobile App to File on the go!

Take advantage of Tax990’s amazing features even when you file the e-postcard!

Filing Form 990-N is a simple and straightforward process that can be done in minutes. You can even access your account on the go with Tax990’s mobile app!

Pricing to File e-Postcard Form 990-N

- Dedicated Customer Support: Our expert team is ready to assist you via phone, email, and live chat for any questions or filing issues.

- Seamless Record-Keeping: Easily access and store your tax filings on our secure platform for future reference or audits.

- Free Retransmission: If your Form 990-N is rejected by the IRS, you can correct and resubmit it at no extra cost.

- User-Friendly Interface: Enjoy a hassle-free experience with our intuitive design, allowing for quick and easy filing.

- File from Any Device: File your Form 990-N anytime, anywhere, using your desktop, mobile, or tablet.

- Mobile App: Download our app to manage your 990-N filings effortlessly on the go!

Trusted by Nonprofits Everywhere

Tax990 Revolutionizes the Tax Filing Process for Nonprofits like Yours!

See What Thousands of Nonprofits Love About Tax 990

How to file Form 990-N Postcard Electronically?

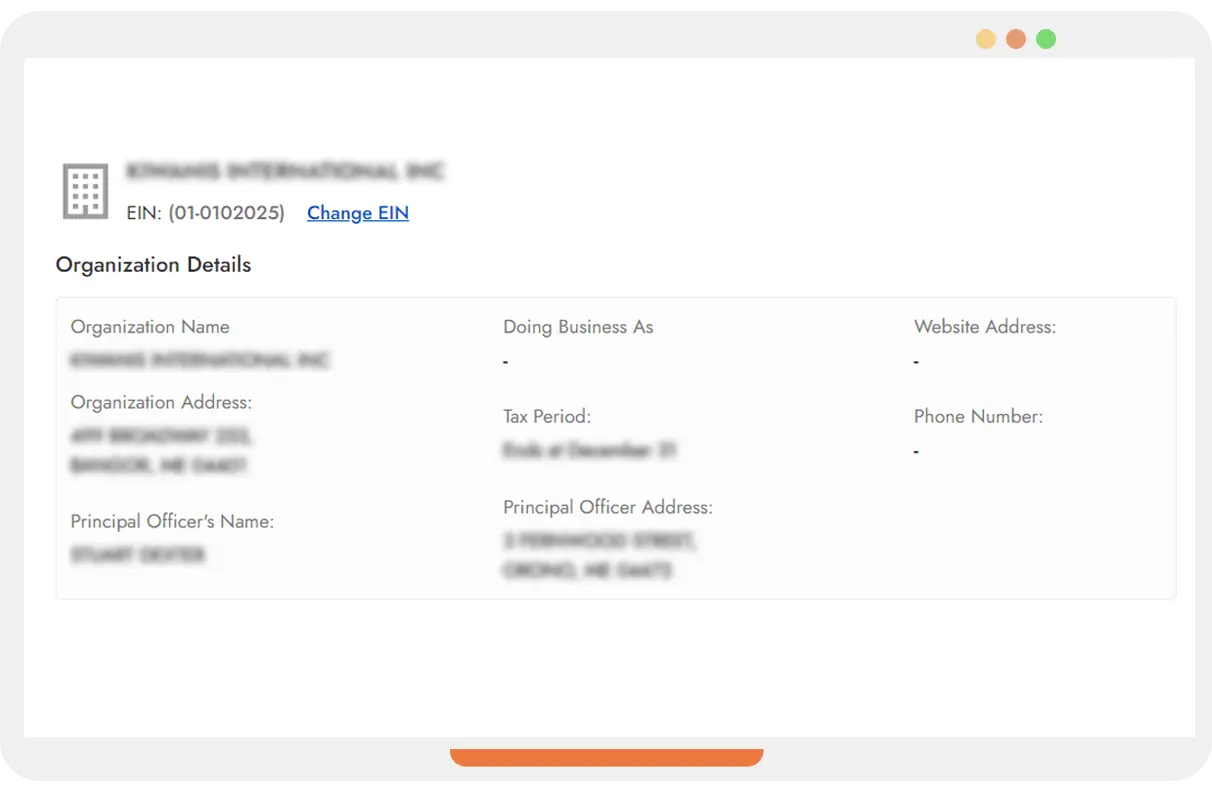

Search Organization’s EIN

Search for your organization’s EIN and our system will automatically import your organization’s basic information from the IRS database.

Choose Tax Year

Tax 990 supports filing Form 990-N for the current and 2 prior tax years. Choose the tax year for which you need to file Form 990-N and proceed.

Review & Transmit to the IRS

Review the details and transmit your e-Postcard to the IRS. Our system will notify you of your filing status via email or text.

File Form 990-N Online with Tax990 Securely!

Information Required to E-file Form 990-N Online

Here is the list of key information that you’ll need to

file Form 990-N online.

- Organization’s EIN

- Organization’s accounting period

- Legal name and mailing address

- Other names of the organization

- Principal officer details

- Organization’s website address (if applicable)

- Confirmation that the organization's annual gross receipts are

$50,000 or less - Statement of termination (if applicable)

Frequently Asked Questions on Form 990-N

Form 990-N, commonly known as an e-Postcard, is designed for small tax-exempt organizations with gross receipts under $50,000 to meet their annual tax filing requirements. This simplified tax return helps small non-profits fulfill their reporting obligations to the IRS easily and efficiently.

Nonprofit organizations with gross receipts of $50,000 or less for the tax year are required to file Form 990-N with the IRS each year.

Note: Organizations that are eligible to file Form 990-N can also file Form 990 or Form 990-EZ voluntarily.

The due date to file Form 990-N (e-postcard) is the 15th day of the 5th month after the end of the organization’s accounting period.

Therefore, if your organization follows a calendar tax year, the filing Form 990-N is May 15 unless it falls on a weekend or holiday.

Upcoming 2025 Form 990 N (e-postcard) Deadline: For organizations with an accounting tax period starting on July 01, 2024 and ending on June 30, 2025, Form 990-N is due by November 15, 2025.

Looking for your nonprofit's tax filing deadline? Click here now!

Unlike other 990 forms, the deadline to file Form 990-N cannot be extended by filing Form 8868

Yes! You can file Form 990-N (e-Postcard) for a previous tax year. However, if your organization fails to file for three consecutive years, the IRS will automatically revoke the tax-exempt status of your organization.

With Tax990, small tax-exempt organizations can file their 990N e-Postcard for two prior tax years.

There is no penalty for late filing Form 990-N. However, if the organization fails to file 990-N for three consecutive years, the IRS will revoke the tax-exempt status of the organization.

If your organization fails to file a 990-N return for three consecutive years, it will become subject to automatic revocation, meaning the IRS will revoke its tax-exempt status. The organization will then be considered a taxable entity.

No, Form 990-N can not be amended once filed. Instead, organizations can file another return with the updated information. However, revoke the tax-exempt status provides you with the option to retransmit the 990-N returns rejected due to IRS errors for Free.

Form 990-N: Form 990-N is an e-postcard that can be filed by small tax-exempt organizations with gross receipts of $50,000 or less. Unlike Form 990, this form doesn’t require detailed information.

Form 990: Certain nonprofits file revoke the tax-exempt status with gross receipts of $200,000 or more (or) total assets of $500,000 or more to report their activities, financial information, and certain other details to the IRS.

Form 990-EZ: Tax-exempt organizations with gross receipts of less than $200,000 and total assets of less than $500,000 should revoke the tax-exempt status to report their financial activities, Program service accomplishments, revenue, expenses, assets, liabilities, and certain other details to the IRS.

Yes! The small exempt organization that is eligible to file Form 990-N may choose to revoke the tax-exempt status or even Form 990 voluntarily to satisfy its annual reporting requirements.

revoke the tax-exempt status is filed by Private Foundations to report their foundation's activities and financial information to the IRS, whereas the 990-N Tax Form is filed by small tax-exempt organizations that have gross receipts of less than or equal to $ 50,000 for the corresponding tax year to sustain the tax-exempt status.

The term Principal Officer refers to an individual in a key leadership position within the organization. This person is typically responsible for overseeing the organization's activities, exercising decision-making authority, and managing overall operations.

Ineligible organization types to submit a Form 990-N (e-postcard ) include:

- Private foundations

- Section 527 Political organizations

- Section 509(a)(3) Supporting organizations

- Section 501(c)(1) – U.S. government instrumentalities

- Section 501(c)(20) – Group legal services plans

- Section 501(c)(23) – Pre-1880 Armed Forces organizations

- Section 501(c)(24) –ERISA sec. 4049 trusts

- Section 501(d) – Religious and apostolic organizations

- Section 529 – Qualified tuition programs

- Section 4947(a)(2) – Split-interest trusts

- Section 4947(a)(1) – Charitable trusts treated as private foundations